TODAY'S HEADLINES

TODAY'S HEADLINES

May 2012

Share Investors turn towards property

Investors in the Share market are turning to property , due to increasing instability in stocks, according to new research. More than a quarter of existing home owners are currently looking to buy either investment or holiday property, according to LJ Hooker Finance.

This result comes from after a downturn was seen in the profitability of the share market, that traditionally drew Australians into investing, said LJ Hooker Deputy Chairman L. Janusz Hooker. While Australians are typically thee highest shareholders per capita, this has begun to see a change Mr.Hooker said. However the double digit losses experienced by the share market in 2011 are driving stronger interest in property investment. Data shows that over a 10 year period property investments yield higher after tax returns than shares.

The survey was conducted by Galaxy Research and involved 1017 participants aged 18 to 64 who are currently active in the property market.

What are your thoughts?

Statement by Glenn Stevens, Governor: Monetary Policy Decision May 1st

At its meeting today, the Board decided to lower the cash rate by 50 basis points to 3.75 per cent, effective 2 May 2012. This decision is based on information received over the past few months that suggests that economic conditions have been somewhat weaker than expected, while inflation has moderated.

Growth in the world economy slowed in the second half of 2011, and is likely to continue at a below-trend pace this year. A deep downturn is not occurring at this stage, however, and in fact some forecasters have recently revised upwards their global growth outlook. Growth in China has moderated, as was intended, and is likely to remain at a more measured and sustainable pace in the future. Conditions in other parts of Asia softened in 2011, partly due to natural disasters, but have recently shown some tentative signs of improving. Among the major countries, conditions in Europe remain very difficult, while the United States continues to grow at a moderate pace. Commodity prices have been little changed, at levels below recent peaks but which are nonetheless still quite high. Australia's terms of trade similarly peaked about six months ago, though they too remain high.

Financial market sentiment has generally improved this year, and capital markets are supplying funding to corporations and well-rated banks. At the margin, wholesale funding costs have declined over recent months, though they remain higher, relative to benchmark rates, than in mid 2011. Market sentiment remains skittish, however, and the tasks of putting European banks and sovereigns onto a sound footing for the longer term, and of improving Europe's growth prospects, remain large. Hence Europe will remain a potential source of adverse shocks for some time yet.

In Australia, output growth was somewhat below trend over the past year, notwithstanding that growth in domestic demand ran at its fastest pace for four years. Output growth was affected in part by temporary factors, but also by the persistently high exchange rate. Considerable structural change is also occurring in the economy. Labour market conditions softened during 2011, though the rate of unemployment has so far remained little changed at a low level.

Recent data for inflation show that after a pick up in the first half of last year, underlying inflation has declined again, and was a little over 2 per cent over the latest four quarters. CPI inflation has also declined, from about 3½ per cent to a little over 1½ per cent at the latest reading, as the weather-driven rises in food prices in the first half of last year have, as expected, now been fully reversed. Over the coming one to two years, and abstracting from the effects of the carbon price, inflation will probably be lower than earlier expected, but still in the 2–3 per cent range.

As a result of changes to monetary policy late last year, interest rates for borrowers have been close to their medium-term averages over recent months, albeit tending to increase a little as lenders passed on the higher costs of funding their books. Credit growth remains modest overall. Housing prices have shown some signs of stabilising recently, after having declined for most of 2011, but generally the housing market remains subdued. The exchange rate remains high even though the terms of trade have declined somewhat.

Since it last changed the cash rate in December, the Board has maintained the view that the setting of policy was appropriate for the time being, but that the inflation outlook would provide scope for easier monetary policy, if needed, to support demand. The accretion of evidence over recent months suggests that it is now appropriate for a further step in that direction.

In considering the appropriate size of adjustment to the cash rate at today's meeting, the Board judged it desirable that financial conditions now be easier than those which had prevailed in December. A reduction of 50 basis points in the cash rate was, in this instance, therefore judged to be necessary in order to deliver the appropriate level of borrowing rates.

Source: Smart Property Invest 02 May 2012

March/April 2012

"The Two Speed Economy"

Rest of the Economy MINING Industry

Good afternoon everyone,

Looking forward to meet the balance of all the members for Canberra before Easter weekend. Who knows I could be knocking on your door, so stay tuned as I continue my “Tour of Duty” somewhere around Australia.

The next economic boom could be here soon as 2014 according to one chief economist, recently addressing a business leaders’ luncheon in Brisbane.

Some of Queensland’s top ASX company CEO’s were in attendance as BIS Shrapnel economist Frank Gelber predicted growth in ailing sectors including property and retail.

“Two years from September will be absolutely bloody booming” says Gelber.

“A lot of people are employed through the mining sector including software suppliers and business services firms that are still not getting enough work, however in the next few years they will be running ragged.”

“Invest in Queensland property will be the primary driver of growth and go off the scale. House prices are set to rise 20% in the next 3 years. Hang onto your hats, it will be a wild ride.” Businesses should not expect to cope with the upturn by simply working staff harder.

“There was zero growth in employment during the past year. We can use existing workers for a while, but eventually companies will need to hire more people” he says.

The Reserve Bank of Australia predicts staff capacity constraint issues will arise in 2 years from now. We will have to move away from cost-cutting and maximizing savings to cater for growth.

So, now we can see that our 2 speed economy is clearly defined between the Mining sector and the rest of Australia. As we are all aware there are 3 major States of Australia that are the highest producers in the Mining sector.

Western Australia - South Australia - Queensland

Western Australia – as you are aware I have just recently returned from Western Australia. Karratha has reached capacity dominating the boom with homes in the region now over $1ml for a standard new 3 or 4 bedroom Home with rentals over $2,000 per week. I am amazed that some investors continue to buy in this area. For all those earlier members who invested 5 and 6 years ago for $350,000 are all celebrating now. Congratulations!!!!

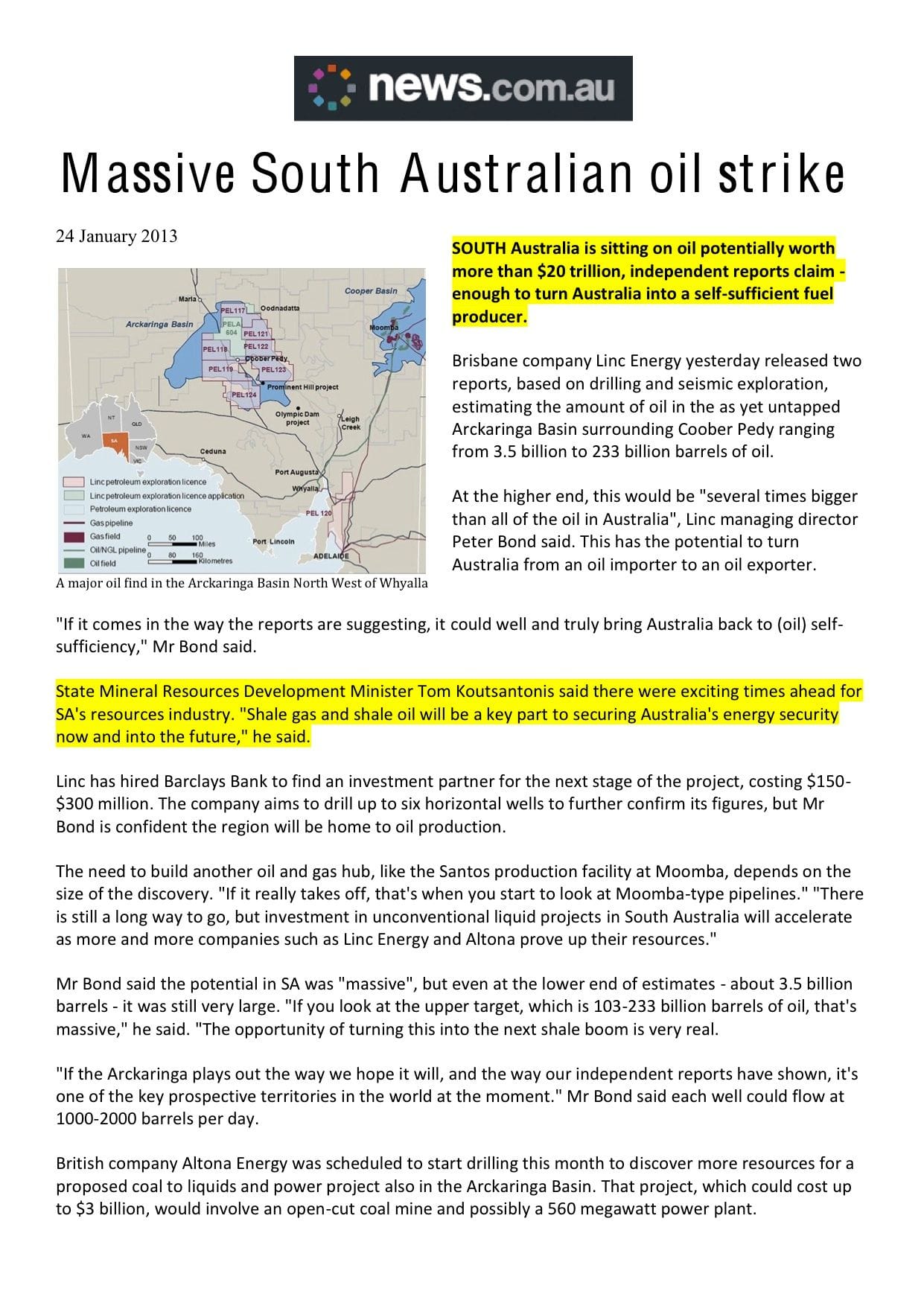

South Australia – is just getting into establishing the earlier stages of major infrastructure in the area however still too early to consider at the moment, we are anticipating over the next 12 to 18 months before any serious returns will begin to flourish.

Queensland – on the other hand has come of age with massive infrastructures already completed with an additional $82ml earmarked in the upcoming Budget. Specific Mining regions within strategic areas have already peaked in prices.

Look what happened when we invested in the 76 House and Land Packages in Emerald! We purchased on Bank Valuations averages at $400K to $412K and settled the last property in June 2010. Rentals were $450 per week. As you are all aware we have periodical valuations 12 months later showing around $28K to $32K increases in equity when the rest of Australia flat lined.

The rental escalated out of control within 12 months to a staggering $600 per week. We cannot continue to invest in this region as it is too expensive now. Similar areas that we invested in over the past couple of years were Gladstone and Mackay. They too have got out of control with an average $100K equity over the past 12 months, again CONGRATULATIONS to all those members.

"Are we in Top Gear or Reverse Gear?"

Future Cost for Retirement

Good morning fellow members,

RISING life expectances and the increase in living expenses means many Australians who retire in the next 30 years are going to be doing it tough. Lucky for us (members) who realized this ordeal in the past and did something about it … OR DID YOU?

Far too many Baby Boomers have ignored the thrifty habits of their Depression-scarred parents and are in for a mighty shock when their employment incomes stops and they have to go on the pension plus whatever their employer has contributed to superannuation.

If you sit down for a moment to work out how much money you had spent over the Christmas period per week, not including your mortgage, then multiply that figure by how many years you are going to live through retirement and you will come up with a staggering figure of money that you need to survive. Deduct your Superannuation and you will have a shortfall of funds that you will need to continue the same lifestyle as you are currently accustomed to … DO YOU HAVE A PLAN IN PLACE??? … SCAIRY STUFF!!!! …

There are a multitude of solutions. Contact me on 0414 888 186 for a FREE Financial Tune-up through our trusted Financial Planners.

One way out is to SELL the family home and rent, another is to REVERSE MORTGAGE – a loan where there is no obligation to make any repayments of principal or interest. The Debt will probably double every 9 to 10 years. Reverse mortgages tend to be misunderstood, but according to Noel Whittaker, co-founder Whittaker Macnaught Financial Planners always believed that they are a great tool in the right circumstances. They enable old retirees to get enough cash to replace the car, go on a world trip and attend to home maintenance while staying in their own home. This is what our family have been advised for my Mum to do now my Dad had passed away.

A Reverse Mortgage enables parents to effectively spend part of their Estate before they die.

The best advice for their children may be to help from their own resources – buying the home at fair market price, giving the parent life occupancy or, at least paying the interest on the Reverse Mortgage. This would stop the debt rising and reduce the effect of rates rising.

Thank goodness we added to our structure to EXPAND our Property portfolio so we could supplement our income during retirement, we don’t have to worry about the rising cost of living like my 80 year old Mum.

Please note that these comments are of a general nature and members should seek their own professional advice before making any financial decisions.

WESTFIELD secures Coomera Town Centre

Good morning fellow members,

Welcome to 2012 as this is our first Newsletter for the New Year. Also welcome to all the new members I met over the Christmas New Year period. We now stand at 8,853 members.

Thank goodness 2011 is behind us now as it was certainly a tragic year for many, including myself. This year my schedule includes catching up with last year’s goals. Let’s hope my prayers from New Years Eve pays off where I have a fat Bank Account and a thin body unlike the reverse of last year …Ha-ha!!!

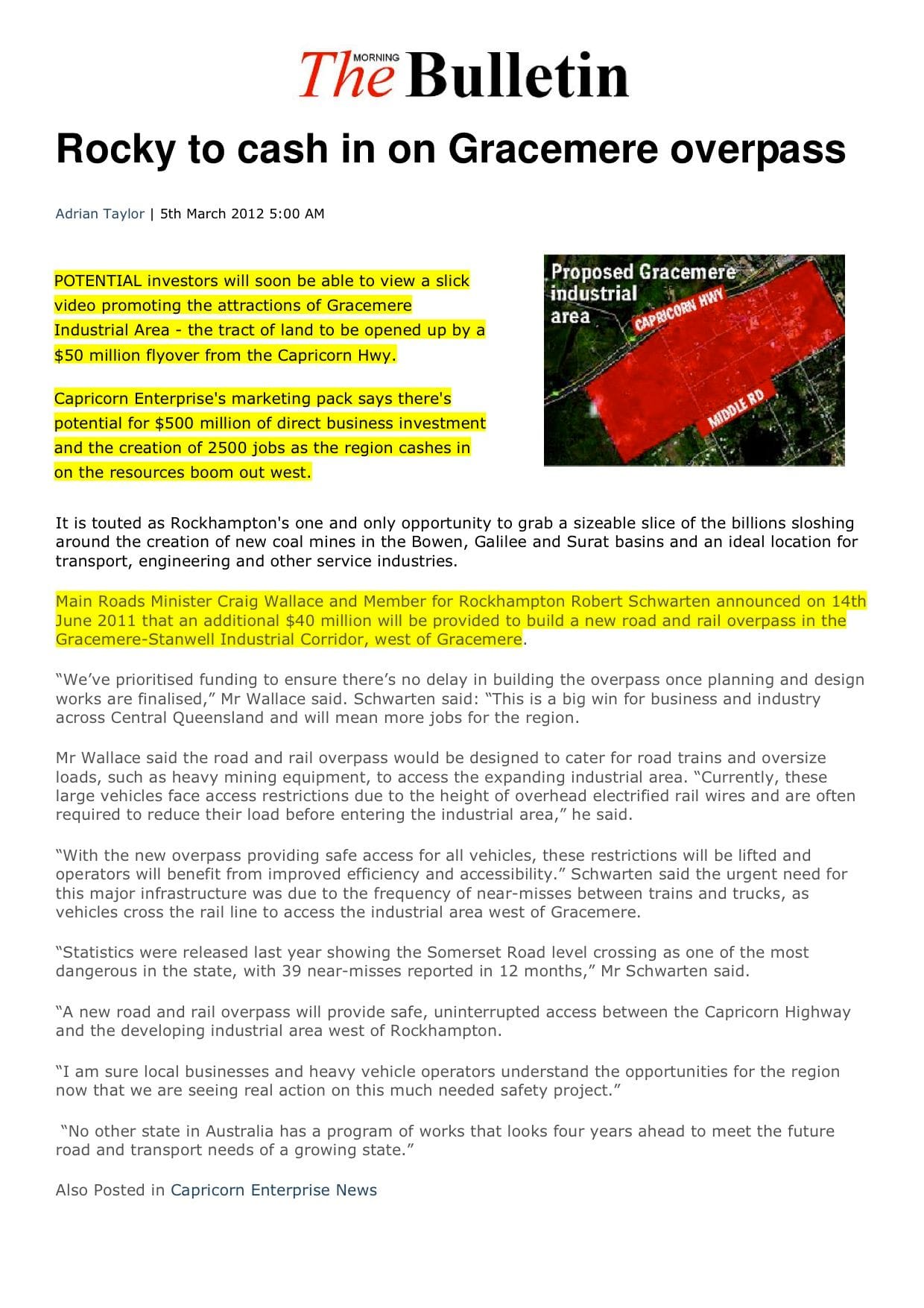

WESTFIELD has secured a massive discount on infrastructure charges for the proposed Coomera Town Centre, clearing the biggest hurdle to the $400 million project in recent years. But while Council has put Westfield on notice to start construction within 12 months of approval, local business owners and residents -- let down by countless false starts for the project over the past 20 years -- are finding it hard to get excited.

The Coomera Chamber of Commerce has slammed the continued secrecy from the council, state government and Westfield over progress on the town centre, delays of which have stymied development on the eastern side of the M1.Chamber president Lionel Barden said it could be five to eight years before a single shop opened in the development which will be a catalyst for a major new CBD for the Gold Coast. "We can't even draw an opinion (on the centre) at this stage because we don't know what's going on," he said. The town centre has stalled in recent years after Westfield was stung with a reported $140 million in infrastructure charges.

Goldcoast.com.au can reveal that Westfield and the city council came to agreement last November on significantly lower charges, which are understood to be well below $100 million.

A relaxation of state government fees last year is understood to have whittled proposed charges to around $40 million. The final figure has not been disclosed and a council spokesman said it would ultimately depend on the approved master plans, of which the first of four has been lodged. A start date is still some time away, although a council spokesman said it "wants to see the project up and running as soon as possible because of the obvious benefits it will have for the Coomera region".

The town centre is being developed by Westfield in partnership with the government-owned QIC on a 35ha site adjacent to the railway station on Foxwell Road next door to FIRMWOOD Estate. Westfield declined to comment on the infrastructure charges or an estimated start date.

Good afternoon everyone,

Trust you had a relaxing time over the festive season as we waddle around saying we have eaten too much and will never do that again, until next time, when we forget that terrible bloated feeling of Christmas Day meals.

My prayer for 2012 is for a fat Bank Account & a Thin Body.

Please don’t mix these up like you did last year.

Amen.

With 2012 nearly upon us, many of us will be spending this week reviewing the events of 2011 and setting resolutions, goals or visions for what we’d like to accomplish next year.

It will come as no surprise that the most common New Year resolutions fall into the categories of getting organized and getting fit … physically and financially.

Financial fitness includes getting your real estate business in order, but you cannot set up your real estate plans in a vacuum. They must coincide with the market.

Here are 4 predictions about what the market context will look like in the coming year for the USA market –

1. Even more Foreclosures – Earlier this year New York Times reported that the additional hurdles New York State courts are requiring banks to leap in the wake of the robo-signing revelations, like additional settlement meetings with the homeowner to see a modification can be brokered, have created a backlog of foreclosures that will take 62 years to clear, at the current rate of foreclosure.

This is scary stuff for the USA, we here in Australia may complain about our banking system and Government restrictions however because of these strict regulations the whole westernized world now is focused on Australia and it successes to ride out this ugly International recession.

2. In the coming year, distressed home sales will continue to represent an increasing share of homes on the market. This in-turn will empower buyers to make smart decisions about what to offer and what to expect on any listing they like, as well as to set smart priorities and make realistic comparisons between listings based on their own personal priorities around timing, certainty and seller flexibility.

Here in Australia we have been buffered by new Government reform to reduce the level of distressed home sales. Lenders have become more understanding to renegotiate terms and conditions where they can so distressed sales are reduced.

3. So, called smart cities will do well. This year a number of housing markets saw double or triple dips in the home values. In others stayed relatively flat. However in areas of technology powers the economy, home values prospered along with the industry.

The FIRM continues to research good stock all around Australia especially over the past 5 years it has become apparent that the mining regions are continuing to grow at unbelievable rates. I will announce our findings in the following bulletins next year that will make you really think.

4. Consumers will get hopeless. I mean hopeless in the best possible ways. For years buyers and sellers have been waiting for that singular event to occur that would cause a quick market recovery. But 2012 will mark the 5th or 6th year in real estate recession depending on who you talk to. The predictions are those consumers who have not already done so will drop unrealistic hopes for a fast return to the heady real estate fortunes of the subprime era. Instead people will make their real estate plans based on –

· Today’s low home prices, rather than fantasy of what could happen if the market miraculously came back.

· Assumptions of very low, or no appreciation in home values for years to come.

· Very conservative estimates of their own finances and how they will grow.

As a result home owners won’t break their necks to hurry and buy before prices rise, rather they save and plan to buy when it makes the most sense for their finances, they will either refi, remodel and be content where they are for the long haul, or decide their homes no longer fit their lifestyle and their finances, divest and move on. But the good news is people will make decisions based on what is or is not sustainable for their lives and their finances, and not based on inflated hopes on what the market will do or not do.

Investors (members) on the other hand, will make well informed decisions based on factual information on the past, present and future of the economy. Being provided with the latest statistics, risk analysis, etc. to make an unemotional decision based on affordability, tax benefits and opportunities. The FIRM continues to deliver all of the above and will continue to do so through 2012.

Enjoy the celebrations and look forward to share a very prosperous New Year for 2012.

So stay tuned for the next exciting episode.

Have a great week!

The Banks & then there is us!!!

Who is the fat little piggy going to market now?

Good afternoon everyone,

Welcome to all the new members who have recently come on board with us over the past few months whilst I have been doing my “Tour of Duty” A very big welcome as we now have reached 8,794 members … CONGRATULATIONS!!!

Over the coming months you will receive plenty of new information relating to the Hottest growth Areas in Australia that are about to explode in the market place, so be prepared to move quickly as these developments are going to be in very short supply.

The BIG four banks have passed on the Reserve Bank of Australia’s Interest Rate cut in full following intense public and media pressure.

The ANZ was the first of the major banks to announce the cut since the Reserve Bank of Australia reduced its overnight cash rate by 25 basis points to 4.25% on Tuesday.

The NAB, CBA and finally Westpac followed ANZ’s move tonight.

UPDATE The FIRM MONEY

As you are aware in the past that The FIRM Money offered very attractive Interest Rates to all the members. We are pleased to announce that our Banker’s Licence has been approved to offer even more attractive rates for the future, exclusive to members only. Our Wall St. Funders will be arriving here in January to finalize negotiations in preparation of the launch in March 2012.

So stay tuned for the next exciting episode.

Have a great week!

September 2011

“Is it time to Buy or Sell”

64% said … Good time to purchase Investment Property

FASCINATING INSIGHT:

Thanks to our Sunday Mail property survey, you can take a peek into the collective minds of the 600 polled Queenslanders who have bought recently or intend to buy soon. Source: The Sunday Mail (Qld)

Good morning everyone,

Another beautiful day in Paradise as we prepare for Natasha’s Engagement Party this weekend, naturally for those members who know Annette she has everything organized. Secret women’s business as they all huddle together planning the special event … I guess this is where us mere males will have to run on instincts as it all unfolds …Ha-ha!!!

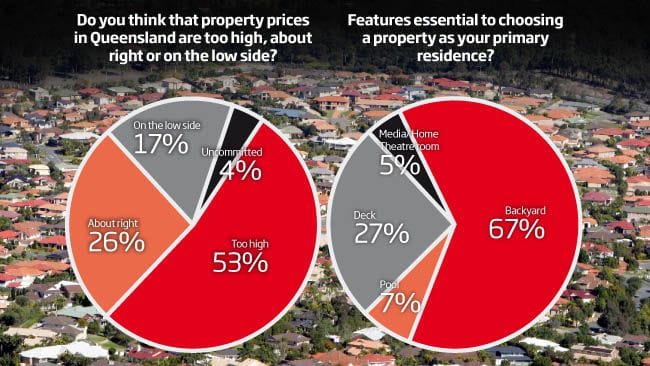

QUEENSLANDERS overwhelmingly believe it is a good time to buy property and that there are plenty of bargains to be had.

In what could be the first sign of a long-awaited recovery, a Sunday Mail property poll has found 74% believe there are "good bargains" to be picked up.

The poll - based on responses from 600 Queenslanders who have bought recently or intend to buy soon - comes as potential buyers move out of their winter hibernation for the traditional spring selling season.

Sales and prices across Queensland have been falling since before the floods and cyclones hit early this year, prompting some sellers to slash prices below their original purchase price to attract offers.

The poll found it was generally a good time to buy (67%), as well as a good time to purchase an investment property (64%).

The strong belief that it is a buyer's market comes despite the view that homes are still over-valued.

More than half those surveyed said prices were too high and only 17% said they were undervalued.

REIQ chief executive Dan Molloy said Queensland real estate prices were at the bottom of the cycle and he expected the market to stay there for at least another six months.It is a question of what happens in the next few months as to whether we will stay at the bottom for a little while before the cycle turns upward again," he said. "We might be at the bottom of the cycle for a little while yet."

Galaxy Research chief David Briggs said while the results suggested Queensland could be heading for another property bonanza, buyers were cautious.

"Few expect property prices to take off any time soon," he said. "In fact, one in three (32%) expects prices to fall in the next six months and 43% expect prices to stay where they are. Only 18% expect prices to go higher in the next six (months)."

Mr Molloy advised buyers not to wait too long or they risked buying as the market started to rise again. And sellers are wary. Only 3% thought now was a good time to sell and real estate agents said many had taken their properties off the market.

August 2011

Courtesy of the Sunday Courier Mail

Good afternoon fellow members,

Another beautiful day in Paradise yet all the doom and gloom around the world makes us all realize that we are certainly in the lucky country or are we!

This interesting article from the Sunday Mail Noel Whittaker’s column says it all.

Have a great day!

July 2011

Massive Developer incentives from $258,000

Less $15,000 Govt. rebate.

How does QUEENSLAND compare…

Stamp Duty on a $400,000 INVESTMENT

QLD.

$11,825

W.A.

$13,015

NSW

$13,490

S.A.

$16,330

Vic

$16,370

Good afternoon fellow members,

Many of our developers are offering very attractive incentives now that the Stamp Duty has increased across the board, yet Queensland is still the attractive alternative.

We have just been informed of another development about to be released in an extremely good location for capital growth from $258,000 less Government bonuses… Interested!!!!

So, the madness continues until the Gold Coast City Council’s clock stops. Spread the word!!! …

“Ten years from now you will be more disappointed by the things you didn’t do than by the things you did”

Call me NOW to be the first 500 people to receive the GRANT.

JUNE 2011

Good morning fellow members,

Well, getting back in the world of reality has been extremely difficult with flashback memories of all the good times, serious times and the difficult times I shared with Gary, I can now sympathise with those who have lost someone very close and the pain that follows. Again, thank you to everyone whose sent their support through email, cards and flowers our family really appreciated your kind generosity and well wishes.

Okay, moving on to other matters, as you are all aware the Gold Coast has been hit with property values declining as the ripple effect from the GFC. As an indication properties that we all purchased 2 years ago are roughly showing that they are worth around the same values. No need to panic as we are all geared well to factor in the shortfalls through our Financial Planners. The good news out of all of this is that building developments have declined with the Gold Coast Residential and Commercial building starts -

Gold Coast 2010 Gold Coast 2011

January: 295 January: 69

February: 475 February: 100

March: 521 March: 69

April: 423 April: 15

Traditionally when these results happen we find that Rentals will start to climb due to the lack of properties available. The FIRM Property Management is in preparation for the increase on demand.

As you can realise now more than ever before, developers and property prices are at their most vulnerable right now to negotiate the best deals. Emerald Lakes (above) are very keen to talk turkey in preparation to the next stage of development.

For more information please go direct to http://the-firm.com.au/hot-property.html

Enjoy your day!

April 2011

Good morning fellow members and associates,

Another beautiful day in paradise as I just finished my daily walk of 4km.

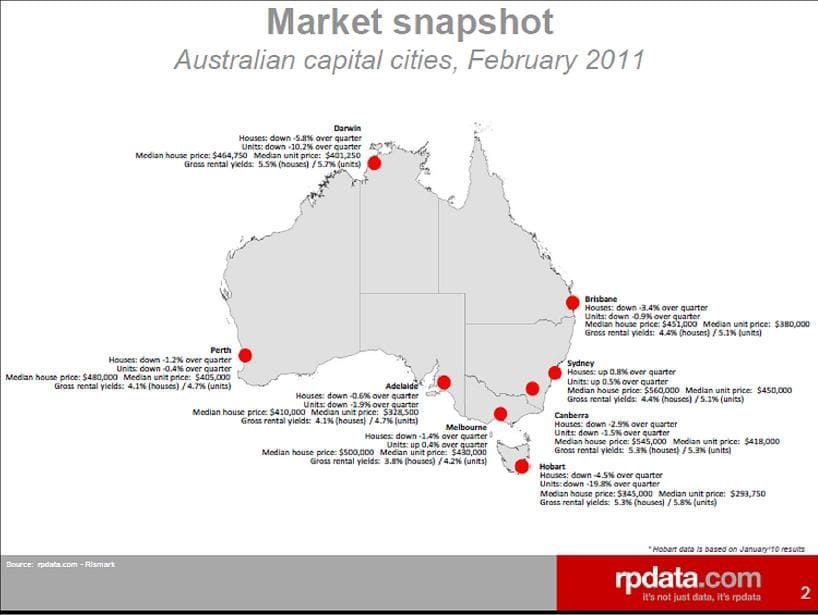

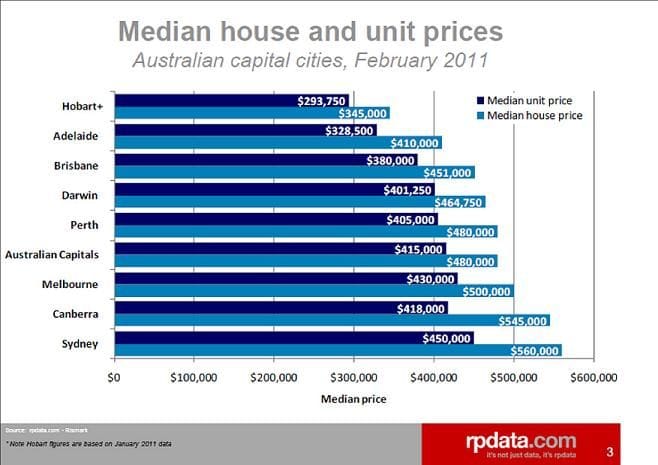

Checking my emails I just received the latest R P Data statistics for February 2011 which I have to share with you.

Good news for all our members as at it meeting today , the Reserve Bank Board decided to leave the cash rate at 4.75%

Did you Know:

The Governor and the Treasurer have agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2-3 per cent. (Consumer Price Index)

You too can predict a most likely outcome of the RBA by looking at inflation.

If CPI looks like it will be increasing above 3% rates will go up.

If CPI looks like it will be decreasing below 2% rates will come down.

If the economy is not in Doom or Boom, then they will most likely say put.

If you too would like to learn more about rocket science 101 click here: http://www.rba.gov.au/monetary-policy/inflation-target.html

If you missed the latest Newsletter with all the exciting news on our Modular Housing http://the-firm.com.au/the-firm-s-newsletter.html

We are currently designing our 1st of 4 Modular Homes to be located in Coomera which will be released very soon, so stay tuned.

Also, interested to hear your feedback on setting up a 2nd Hand Division for all our aging properties.

Have a great week and we will chat again soon.

"How does your property investment value today"

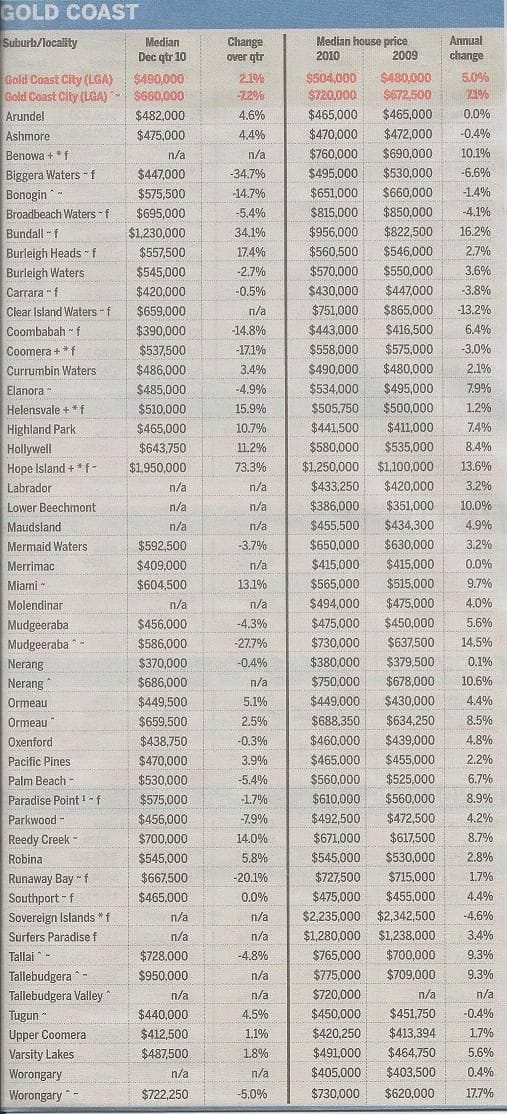

SOURCE: REIQ Data made available by QLD Department of Environment and Resources Management (qvas)via pds live and RP Data

Courtesy The Sunday Mail February 20, 2011

Good morning Fellow members,

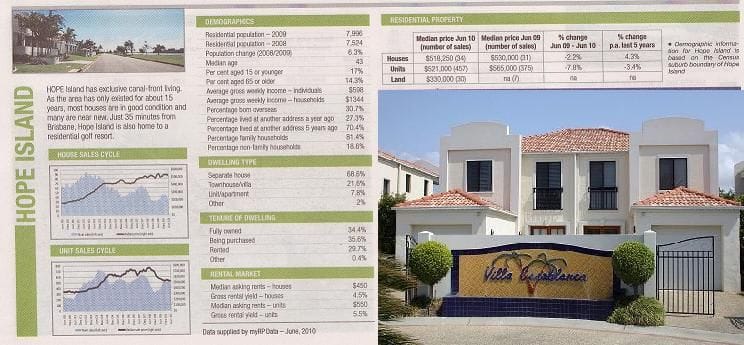

The official figures have just been released for the past quarterly change October to December 2010. The best selling suburb on the Gold Coast for the quarter was Hope Island 73.3%. I dont mean to boast but is'nt that where most of us focused on investing over the past couple years? ... We did it again ... Thankyou for your support!!!

Desperate sellers are are slash home prices just to get a sale. It is a bonanza for buyers as desperate sellers drop their price, in some cases by millions.

One beachfront mansion on Hedges Aveon the Gold Coast sold for less than half the $11ml the owner paid 3 years ago. But it isn't just the luxury market that has suffered. A two-bedroom two-bathroom apartment at Portside, Brisbane which the owners paid $760,000 for in 2004 is now listed at $725,000.

Meigan Hetherington, from buyers agency Property Pursuit said there are more sellers than buyers, banks are more cautious with home loan approvals. The financiers have been quite strict and tightening up their lending criteria.

We are optimistic that property values will climb this year. A Galaxy Poll survey revealed that 39% of the people believe will rise in the next 12 months with another 40% expecting to stay at current levels. Only 18% of the respondents are picking a drop in values. But their view is not shared by experts. Property analyst Michael Matusik predicts values to drop by 5% to 8% this year potentially bouncing back next year.

It's not all doom and gloom as the market rises and it falls from time to time, thanks to our Financial advise in the past, we have weathered the storms to sit and hold our port-folio's which are well serviced with strong rental returns and maximum tax benefits. The downside is that our acquisitions over the past couple years have only risen slightly compared to the other years and we do not have sufficient equity to leverage our expansion. It is so frustrating to see all these bargains slipping through our fingers and not able to jump on board at the moment.

So, it is really a buyers market out there, if you have the cash available to take advantage of the frenzy, then call me. We now have new bargain properties available from $375,000 upto $25,000,000

Check out Hot Property for some real bargains - http://the-firm.com.au/posh-property-.html and http://the-firm.com.au/hot-property.html

As a footnote, Jayden now 12 years old has been competing over the weekend in the District Ironman tournament and came 4th yesterday so now he goes to State. Today he has other events and will keep you posted. Have a great Sunday!

Coomera Myer Planned

Courtesy Gold Coast Bulletin Friday 19th November 2010

This will be the 3rd Myer Store on the Gold Coast as the newest store opened in Robina last week. Scheduled to open in 2014 makes Coomera definatley the Hot Spot for the future. Congratulations to all those members who have supported the area over the past 18 to 20 years and also to all those new members who have just realised that Coomera Central is the place to be. The new school opposite will be opening soon for next year as they put the finishing touches of landscaping, driveways and fencing around the perimeters.

RENTS TO SKYROCKET

Property prices LOWEST + HIGH Rental return + LOW Bank interest = BUY - BUY - BUY!!!

Courtesy Gold Coast Bulletin Monday 1st November 2010

Good morning everyone,

Trust you survived the onslaught of kids screaming 'trick or treat' over the weekend, great excuse for another social which ended up at the park next door with all the locals supplying the cheese and wine. Who said Halloween was just for kids ... Ha-ha!!!

Melbourne Cup Day tomorrow, hope you back a winner. I will be sharing the activities with new members from Blackwater.

Interesting response from our latest Headlines where the Federal Government are considering abolishing the Aged Pension. Thank you for referring your friends and relatives, hopefully we can save them before it is too late.

Another rise in the Australian Dollar against the Greenback from last Friday with an increase of 1c.

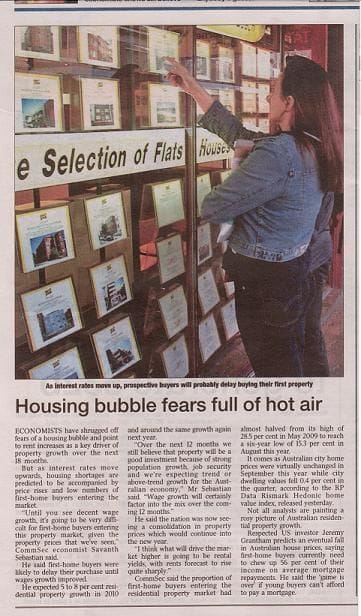

Economists have shrugged off fears of a housing bubble and point to rent increases as a key driver of property growth over the next 18 months. CommSec economist Savanth Sebastian said he expected 5 to 8 % residential property growth in 2010 and around the same growth next year. Over the next 12 months we still believe that property will be a good investment because of strong population growth, job security, and we are expecting a trend or an above average growth for the Australian economy.

With the lack of new developments being constructed and the restrictions on bank lending has created the shortage of properties available for rent. Remember back mid 2000's when we had the rental auctions, well, from what the experts are calculating we may just be coming into those times again.

Property prices LOWEST + HIGH Rental return + LOW interest = BUY - BUY - BUY!!!

Check out the latest Hot Property http://the-firm.com.au/hot-property.html

Have a great week and stay tuned when we release our new modular housing program and who we have sourced to be our building company.

Courtesy Sunday Mail, October 24, 2010

Good morning fellow members,

What a beautiful Sunday morning up here on the Gold Coast as I relax reading the Sunday Mail whilst finishing my breakfast when I read this alarming article and had to share it with you.

The Federal Government is considering creating an on line league of super funds amid grave concerns held by ordinary Australians about their retirement nest eggs and fears the age pension will be axed.

Most Australians mistrust their superannuation fund - with a whopping 44% convinced their super fund is ripping them off. But the feelings go deeper than that. Super funds are run by trustees who are required by law to the interests of their members first.It is all the fees, charges and commissions, deducted automatically from their savings that people hate the most, and understand the least. The NTAA (National Tax Advisors Association) is concerned that Govt. reforms will stop accountants advising on super especially self managed super. Large financial institutions want to stop tax payers setting up their own funds so contributions can be diverted into their own coffers spending millions of dollars each year on advertising, communicating directly with its members on sporting sponsorships, marketing campaigns and public relations consultants.

One of our new retired members recently reminded me that he lost over 30% of his super at the stroke of a pen 2 years ago and was told the GFC was to blame, and now at 72 years old has to go back to work to replace his losses and now start his property port-folio to secure a better lifestyle for he and his wife. How many times are we hearing familiar stories ... We must be doing something right!!!

Do you trust your Super Fund?

7,952 Members can not be wrong.

Who will be our 8,000th Member.

Save your friends and family before it is too late!!!

Check out the latest bargains on http://the-firm.com.au/hot-property.html

The RBA's board holds its next monthly monetary policy meeting on November 2 and will announce its decision about 30 minutes before the running of the Melbourne Cup.

Okay, I am off now to see the Road Warriors enter the colossium of speed with the V8 Supercars at the Gold Coast 600.

Have a great Sunday and look forward to hear your comments on your Super fund!

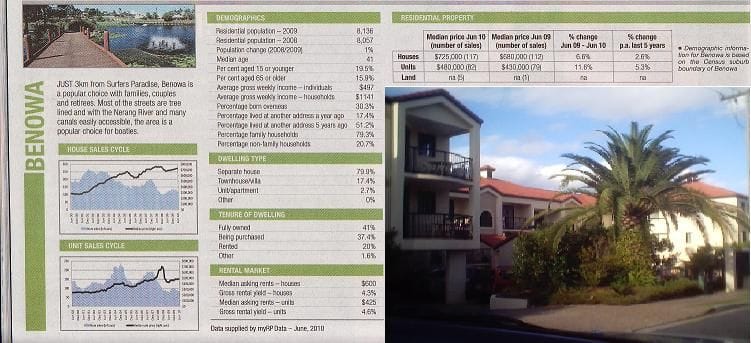

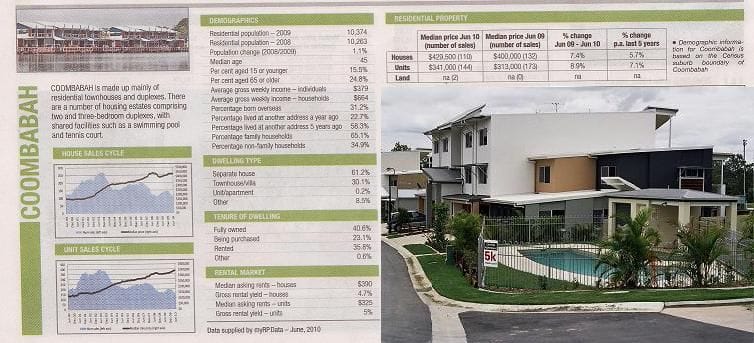

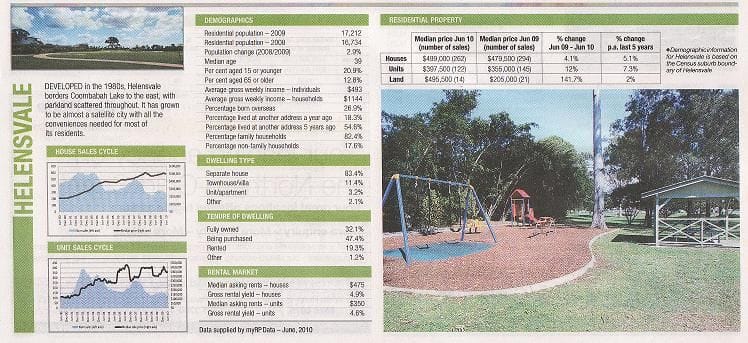

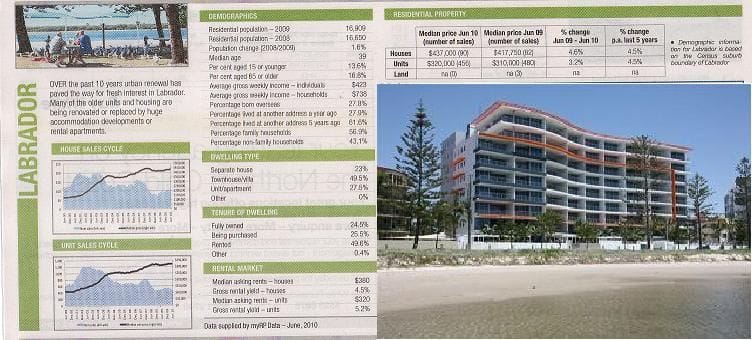

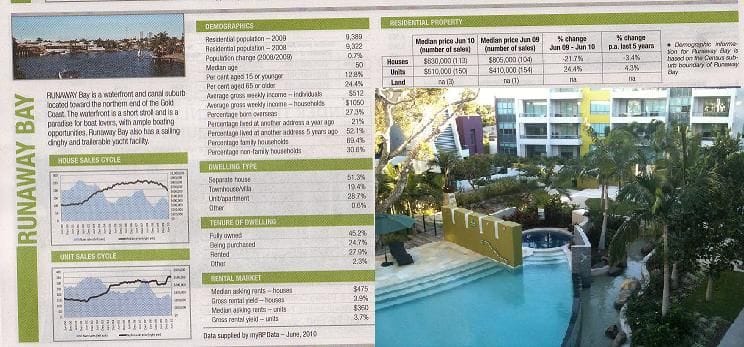

2010 Gold Coast Annual Property & Suburb Guide

Courtesy Gold Coast Bulletin

Good morning fellow members,

The moment you have been waiting for all year as the Gold Coast's annual property bible has just been released this morning. Lets see how our investments performed over the lean year that we have all experienced. These figures show an insight into all our property investments. Due to the fact of sending out a large file to you I have highlighted the main areas that we have targeted over the years. If your suburb is not listed please email me and I will forward to you next week.

As you know most of us are led by lifestyle when searching for your own home, however when we search for investments a different set of rules come into play, including values, infrastructure, rental returns and of course the tax benefits. As I have mentioned to you on numerous occassions we have 3 partners to consider for our investment.

- You

- The Tenant

- The ATO

Satisfy all three and you have a perfect synergy between partners.

Source the perfect suburb and property for growth, Finance and Management through The FIRM (perfect track record for over 20 years) and you have the perfect Property Invesment Port-folio.

What ever you are searching for in your next investment odds are it will be here on the Gold Coast. According to RP Data, a home on the Gold Coast will set you back an average of $500K. The Median sale price achieved by units is $375K. The 34% of the Gold Coasters renting accommodation are paying an average of $420 per week for a house and $340 per week for a unit.

Have a great weekend as we are heading down to Sydney to surprise Annette's Mum for her 80th Birthday celebrations.

Enjoy the statistics as we continue to deliver our "Standard of Excellence"

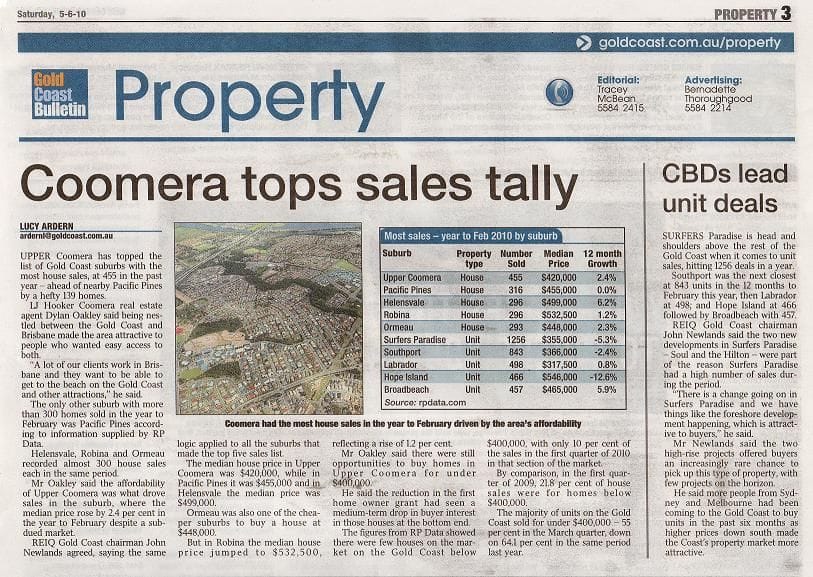

Courtesy Sunday Mail June 6th 2010

Good morning everyone,

Another beautiful day in paradise, having breakfast in bed (special treat) with the warm winter sun streaming through as I lay here reading the Sunday Mail.

There is movement afoot as very large Australian and International developers are preparing for the Queensland Government's answer to the population squeeze. Property records show large numbers of savy investors have anticipated the Government decission.

Stay tuned on FIRMWOOD Estate as the timing maybe earlier than you think!

Courtesy Weekend Bulletin 5-6 June 2010

Coomera has topped the list of Gold Coast suburbs for the past year with Pacific Pines coming in second place.

Congratulations to all those members who have supported all the developments in Beattie Road, Coomera - Savannah Palms, Savannah Waters, Oak Park, The Cove, Evergreen Manors, Beattie Place and Samarinda.

Also congratulations goes to all those members who supported all the developments - Harvard Mews, Oxford Mews, The Landings, and all the those House and land packages in Coomera as well.

Well Done ... We have done it again, despite the slowing down of the economy and lack of new development in the area due to funding approvals for developers.

Check out Hot Property for the latest release as they are becoming a very rare commodity at the moment http://the-firm.com.au/hot-property.html

Enjoy your Sunday as I continue to enjoy mine.

Have a great week and chat soon!

Another beautiful day in paradise especially now the weekend has arrived after one of the busiest exhausting week's I have had for a while.

We have a very "SPECIAL ANNOUNCEMENT" that we wish to propose to you soon, so stay tuned for another exciting episode of the next bulletin.

The Sanctuary Cove Boat Show has launched, and this year I don't have to go as I had a sneak peak preview of all the stunning boats cruising by my front door over the past few days ... DROOL!!!! ... It's a wonder I got any work done ...Ha-ha!!!!

TODAY'S HEADLINES

Courtesy Gold Coast Bulletin Business Friday 21st May 2010

Rising rates are discouraging first home buyers and keeping them into the rental market which in turn is good for all of us, says a mortgage broker.

Property investors like ourselves who say they are not deterred by rising interest rates, can look forward to strong rental returns as larger numbers in the rental market keep from rents from falling.

A survey released by on-line brokerage e-choice yesterday found 41% of would be investors would reconsider if rates rose over 2% points compared with 53% or current prospective owner occupiers.

Check out HOT PROPERTY - http://the-firm.com.au/hot-property.html

Have a great weekend and stay tuned for our "SPECIAL ANNOUNCEMENT"

What your investment is worth?

Good morning everyone,

Trust you had a wonderful weekend with a little less rain than previous weeks.

Yesterday's Weekend Courier Mail released the latest REIQ official figures in this 8 page report -

http://www.couriermail.com.au/extras/cm_yourhouse/index.html

Have a great week!

Chat soon!

Are you born between 1946 and 1964?

Good morning fellow members,

For those members who missed our The FIRM's Business Plan 2010 The New Decade click to receive the update ... Compelling reading!!!

I think you will be pleasantly surprised what goals have been set for this year. I would be especially very interested to hear your comments on the new rapid building methods that will revolutionalise our current stick frame method of building. This new technology will save all the members massive $$$ for the future.

Ken and Nancye Ibbitson

For more than 30 years now there have been warnings galore about the baby boomers leaving the workforce. Our exit will cause shortages in labour, put pressure on wages and increase health services. This has been a ticking time bomb to all Governments, past and current. There has been plenty of talk however no action in the political arena. "In 1997 the Howard government tried to fix the crisis in the nursing home industry by introducing accommodation bonds . Labor ran such a scare campaign the scheme was dropped'' says Noel Whittaker Sunday Mail January 24 2010.

The scary scenario is that we all have been saying this for years. If people were well informed and act early, they have a chance to make a significant difference to secure a better lifestyle for their future. The Governments will not be able to support us ... the writing is on the wall. Thank goodness we, the members, have started to make a difference. They claim that new medical breakthroughs may extend our forecast of life expectancies. If this is the case, then can you imagine that we are way off the mark for health and welfare budgets which places more pressure on society.

My Mum and Dad pictured above are a constant reminder to me that we are all aging rapidly. My dad recently celebrated his 80th birthday, has had multiple emergencies to the hospital for major heart surgery, yet he doesn't qualify for a Pension due to his assets. If he didn't have the assets to support him that accrued equity over many years then how could he survive? Fortunately for both of them now they can enjoy the fruits of their labor, touring the world in armchair comfort on exotic cruise lines, with all their meals being prepared, meeting new friends and being pampered.

I am sorry ... I don't want to wait until I am 80 to start to enjoy retirement ... I am 57 years old this year, ("hint" 9th June) still healthy and have an active property portfolio, so I wont get the pension either ... so I want it now!!! ... Don't you?

"Stay tuned as I have a plan"

Drop me line, interested to hear your comments!

TODAY'S HEADLINES

Ultimate Event Auction

23rd & 24th January 2010

Yesterday's Ray White "Ultimate Event Auction" has sent shock waves across the country with more than $67ml worth of local residential sales compared to 2009 where $31ml was sold at the 'Event'.

According to leading property agent Andrew Bell, CEO, Ray White, Surfers Paradise (personal friend) the investor group was a sign that the Gold Coast was moving into positive territory. The upbeat sales are a reflection of the property bubble slowly inflating again after a troubled 2009.

More than 800 people turned up to the record breaking 'Event'.

These are all good positive signs that the Gold Coast's economy is on the rise. Glad you invested in the Gold Coast as the 7 year cycle is on the way back.

Have a great week, enjoy Australia Day and look forward to hear your comments!

Chat soon!

Good morning fellow members,

Yesterday morning I lay there contemplating the day's events pretending to be asleep when young Jayden gently nudged me saying "Happy Father's Day" with a grin from ear to ear, proud as punch, presenting a block of Toblerone Chocolate and a card. The excitement was mainly focused around the chocolate bar as he insisted to help unwrap the present. Naturally, he insisted to sample it for me and how could I refuse those big brown puppy dog eyes ... Ha-ha!!!!. The day went very well as we joined up for Nippers at the Karrawa Surf Life Saving Club at Broadbeach enjoying a beautiful breakfast overlooking the beach and then on to the Junior Golf at Hope Island Golf Club. An exhausting day as I fell asleep during the news. Trust all the Dad's had a special day also.

The latest figures have just been released, and as predicted our choice of the developments in the highlighted suburbs have been the best performers, no surprises there, congratulations to everyone for having the faith in supporting all of us as we continue to deliver our "Standard of Excellence"

Also to a few new members who have recently joined us, thankyou for forwarding your information to us and as a reminder to the stragglers, can you please forward your Assessment Applications to us as soon as possible.

Enjoy your week!

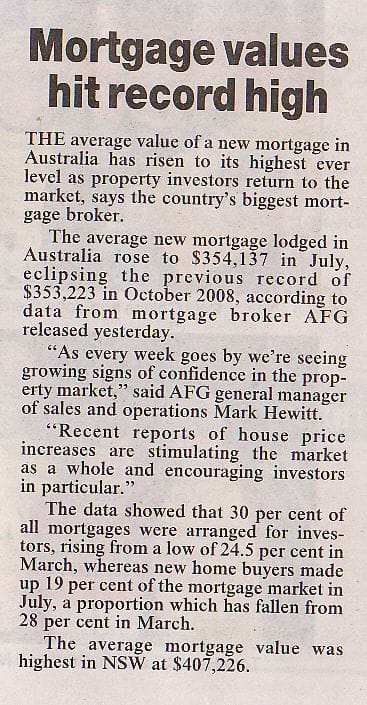

Good morning fellow members,

Get ready ... Get set ... as we are ready for the growing signs of confidence in the property market starting to move upwards on a weekly basis and this is not generated by the First Home Owners.

Lets hope the bank valuers read this article so they can be a little more responsive to our existing port-folios so we can leverage our equity to go shopping again soon.

Like to take this opportunity to welcome a few new members who also have property in the same developments as we have for the past 10 to 15 years, trust you will enjoy the information that we provide to you. Welcome to The FIRM.

Current membership now is at 7,181 members.

Stay tuned for the latest update to our Building Society which will be released soon. Variable or Fixed at the best interest rate, that is the question???

"Stamp Duty on Home Loans

to be scrapped"

Good afternoon fellow members,

Stamp duty on housing loans is set to be abolished after the Henry tax review, which is likely to recommend states be given a share of income tax to make up the difference.

The most likely path to do this would be for the commonwealth to give the states the ability to impose their own surcharge on income tax, which would be collected for them by the Australian Tax Office.

The Henry review has been inundated with submissions calling for the end of stamp duty. Tax economists argue that the tax on moving house, although easy to collect, leads to poor use of the housing stock and poor labour mobility.

Having to pay stamp duty not only discourages elderly people from moving to more appropriate accommodation, it also deters people from moving house to a better jobs market.

At a conference conducted by the Henry tax review at the Melbourne Institute last week, both international and Australian tax economists said stamp duty should go, with Melbourne University professor John Freebairn describing the tax as "a piece of garbage".

The review panel is being influenced by state submissions arguing that replacing stamp duty by extending other state taxes, such as payroll tax or land tax, would be too difficult to implement nationally.

Tasmanian Treasury secretary Don Challen, who is close to the inquiry's head, federal Treasury secretary Ken Henry, told last week's conference that reform of state taxes would succeed only with leadership from the national government.

"If you want to achieve a difficult reform, you've got to make it a national one," Mr Challen said.

He said it would be too hard to win political consensus to extend land or payroll taxes.

"It requires eight lots of political commitment and eight lots of legislation and that path is doomed to failure," he said.

However, he said he believed states would be willing to act on stamp duty if the commonwealth provided an avenue for alternative revenue. The idea of giving states a cut of income tax was pressed two years ago by the OECD, which suggested the states "piggy-back" on income tax. The OECD also urged states to drop stamp duty.

One of the world's leading experts on federal taxes, Canada's Richard Bird, said the states were heading for a financial crisis because they did not have a sufficient tax base to support their burgeoning health and education costs, which were all rising much faster than the consumer price index.

One of the problems with stamp duty for the states is that it is vulnerable to the state of property markets. Stamp duty usually raises about $14 billion a year for the states, but the recent state budgets showed big falls of more than $1bn each in NSW and Queensland, in 2008-09, for example.

"In Australia, it should certainly be feasible to permit states to impose a surcharge on the federal personal income tax base," Professor Bird said.

He said that, ideally, Australia would follow the Scandinavian practice of allowing states to have a flat tax surcharge on income, rather than mirroring the commonwealth's progressive taxation. The states would be allowed to set their own level, making states more responsible for their own finances.

It would require a surcharge on income tax receipts of a little over 1 per cent to match the income raised by conveyancing stamp duties.

Dr Henry has not given his views; however, in a speech earlier this year he canvassed the possibility of states levying different rates on a nationally consistent tax base.

"Such an approach could avoid problems with tax-base erosion from interstate competition and make it easier for businesses to understand and comply with their obligations, while still providing the states with a policy lever to respond to jurisdiction specific preferences," Dr Henry said.

He said the review was close to putting some "big ideas on paper", but he would take advice from the government about whether the review could consult broadly about them before completing its final report, scheduled for the end of the year.

Dr Henry said that one of the problems facing the inquiry was that it was not motivated by an immediate crisis in the tax system, so it was hard to build support for radical tax change.

"The Australian government has identified an opportunity and asked us to come up with reform proposals that will be durable and anticipate changes like demographic change," he said.

Dr Henry said many of the review's ideas would be for implementation over a longer term; however, it would also have some more immediate suggestions.

Australian School of Taxation director Neil Warren said state taxation was likely to be at the top of the list for immediate change because it could be achieved without too much political fall-out for the federal government.

Chat soon!

HAPPY EASTER

LABRADOR #1

Highest RENTAL YIELDS for GOLD COAST

December Quarter 2008

Highlighted suburbs are our target investments over past 20 years

Courtesy Gold Coast Bulletin, Thursday, April 9, 2009

Good morning everyone,

Today's headlines say it all with all our members who invested in Varsity Lakes and Coomera coming in hot on the heels of Labrador, yielding 5.7% for the December quarter ... Number 1 for the highest rental yield ... Well done!!!

The highlighted areas are where we all focused over the past 20 years. I remember when we could buy in Labrador for under $60,000 one street back from the Broadwater and the gross yield was 5.2%. I guess the real exciting news is that we have achieved enormous growth over that period with our units now worth well over $325,000. Even the lower end of the scale of postcodes are all achieving fabulous results with little to no vacancy compared to some of the mining towns who achieved higher returns in the earlier days are now ghost towns.

All of the Gold Coast's units and townhouses are racking in very healthy ye